Summary

The Texas economy continues to grow but at a more modest pace in the face of lower energy prices and a strong dollar. Total employment expanded but was weighed down by the manufacturing and oil and gas extraction sectors, especially in Houston. Housing demand remained strong throughout Texas while new construction was constrained by a shortage of skilled labor and limited developed lots.

Supply

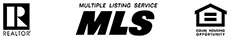

The Texas Residential Construction Leading Index (RCLI), which signals upcoming directional changes in the residential construction business cycle, registered a strong increase in October. The RCLI was positively affected by increases in weighted building permits and housing starts. The Texas Residential Business Cycle (Coincident) Index that measures current construction activity turned down in October after a slowdown in activity during prior months. Single-family housing construction permits statewide remained flat in October with declines in Austin and Houston and slowing in Dallas. No major MSA has reached its prior peaked permitting levels. Housing starts in Texas continued to climb in October 2015, helping to alleviate the restricted supply.

Months of inventory for existing homes across Texas remained low but registered modest upticks the past couple of months to 3.5 months of inventory in October (around 6.5 months of inventory is considered balanced).

Demand

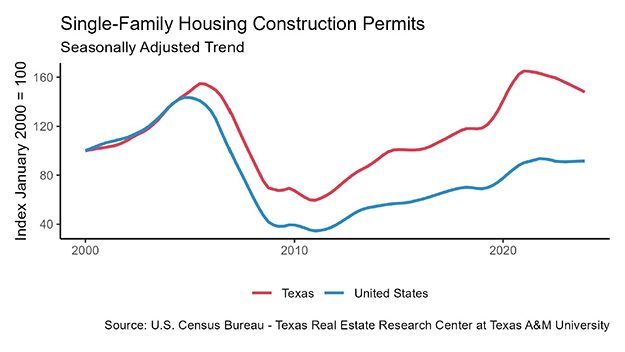

Texas housing sales passed January 2007 levels in August on a total seasonally adjusted monthly sales basis. In October, statewide housing sales increased 3.6 percent year-over-year seasonally adjusted although they decreased 2.1 percent on a not seasonally adjusted basis. Four of the five major Metros posted solid home sales increases. In October, Houston experienced a negative 2.9 percent year-over-year seasonally adjusted change (negative 11 percent not seasonally adjusted). Overall, 2015 Texas home sales remained positive, but the rate of growth has lagged behind the nation. Nationally, mortgage interest rates have remained slightly below 4 percent. In October, the Federal Home Loan Mortgage Corporation reported a 3.80 percent rate on a 30-year fixed-rate mortgage, while the 30-year U.S. Treasury bond yield equaled 2.89 percent. On December 16, the Federal Reserve raised the fed funds target rate and will make further adjustments depending on the performance of the national economy that could lead to somewhat higher mortgage rates in the future as monetary policy remains accommodative.

The number of days an existing home was on the market has remained low relative to prior periods reflecting the tight supply. New homes had somewhat longer sales periods in October in Austin and Houston compared to Dallas and San Antonio. The average statewide difference to sell a new home versus an existing home was 41 days in October, the largest difference since January 2011.

Prices

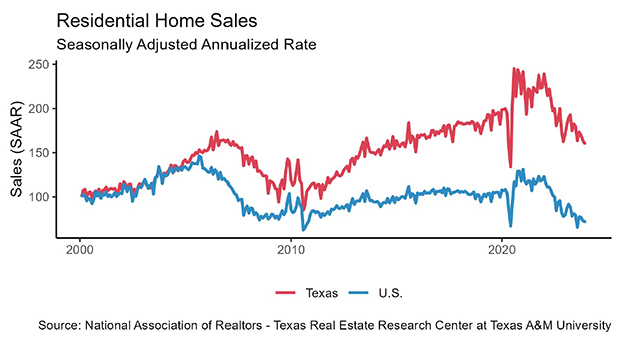

Average and median sales prices have risen dramatically in Texas since 2011 and continued to climb in October. The constrained supply in conjunction with strong demand accelerated price gains. Austin and Houston have been the house-price appreciation leaders in the first half of 2015 followed by Dallas and San Antonio. Due to recent declines in the energy sector and the resulting economic slowdown, Houston has begun to exhibit a softening in price growth. Non-energy employment growth and a strong services sector caused Dallas to register even stronger price appreciation.

Texas’ existing and new home sales prices have steadily climbed in the major Metros. Since 2011, on average, new home prices have been 48 percent more than existing home prices based on median sales prices and 37 percent more based on average sales prices. This is primarily because of increases in home size for newer homes and significant increases in construction and land costs. The price per square foot for a new home in Texas has been 20 percent more than for an existing home.

Even with rapid price appreciation, purchasing a home in Texas continued to be relatively affordable compared to the rest of the United States, but the gap appears to be closing.

Original article: https://www.recenter.tamu.edu/articles/technical-report/Texas%20housing%20economy%20leading%20index%20construction